Who believes that there are 87,000 accountants out there available to fill the positions that will be required with the “Inflation Reduction Act” Considering that the IRS cannot fill their positions for IRS agents now just who will be these new candidates? Setting aside a few thousand for IT it sure is a boatload of agents.

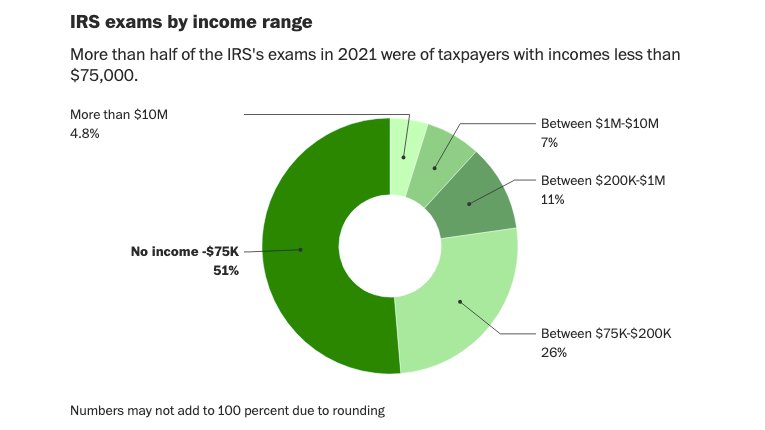

The IRS audited Americans earning $25,000 a year at FIVE TIMES the rate of other groups last year.

They claim they need so many accountants in order to go after the very rich. The fact is that it takes CPA’s to audit the rich due to the complicated and confusing tax code. How many CPA’s after all their education want to spend their lives working for the IRS?. Not many according to my CPA when I asked him this week.

WE’RE HIRING SPECIAL AGENTS NOW!

Key Requirements

- Be a U.S. citizen

- Be 21 years of age by the time that you complete the training academy and no older than 37 years of age at time of appointment.

- Qualify based on education, specialized experience, or a combination of the two.

- Possess a valid driver’s license.

- Pass a background and criminal history record check.

- Pass a pre-employment medical exam.

- Pass a pre-employment drug test.

- Pass a pre-employment tax examination.

- Be legally allowed to carry a firearm.

Major Duties

- Adhere to the highest standards of conduct, especially in maintaining honesty and integrity.

- Work a minimum of 50 hours per week, which may include irregular hours, and be on-call 24/7, including holidays and weekends.

- Maintain a level of fitness necessary to effectively respond to life-threatening situations on the job.

- Carry a firearm and be willing to use deadly force, if necessary.

- Be willing and able to participate in arrests, execution of search warrants, and other dangerous assignments.

More at “IRS”

The agenda included in the Inflation Reduction Act of the IRS-

“…to provide digital asset monitoring….”

In the original BBB bill, this section took up a page. Now, it’s ten pages long. It starts on page 1926 of the current version of H.R. 5376 and on page 39 of the Senate’s draft Inflation Reduction Act; versions are slightly different but the total is the same. In the $45 billion enforcement section, we’ve got “…to provide digital asset monitoring….”

If that doesn’t make the hairs on the back of your neck stand up I don’t know what will. The IRS should be concerned only with assets it suspects are being funded through tax fraud and it doesn’t take $45 billion to do that. But to establish the ability to implement Senator Warren’s unconstitutional “wealth tax,” well, it might just be enough.

Another idea of what they could be doing:

Congress in its wisdom recognizes that there are no 87,000 accountants. How do I know?

Buried in the wording is a paragraph giving the Secretary of the Treasury the ability to hire directly into the competitive service without regard for current laws that mandate publicly announcing available competitive service openings. The Secretary can ignore all federal laws that give hiring preference to veterans, the disabled, former employees (that would include those fired for not taking the co-vax), military spouses, Peace Corps volunteers, etc. That’s one way to make sure only those who meet a political smell test get to participate in this new IRS enforcement program.

So the new so-called agents will be hand-picked. No public announcing of the position. Am I the only one that thinks it odd? How about the educational backgrounds? If the IRS is going to unleash thousands of IRS agents don’t we need to believe that they are qualified ? Or are they merely to harass the “chosen” by the administration? Just asking.

If we accept a premise that we will have tens of thousands of individuals that really aren’t qualified to examine tax returns one has to ask just what will they be doing?

If anyone thinks that the Biden regime would like to return to the halcyon days of Obama let’s look at an idea of what else they could do.

Now an IRS agent in every Church? Agrees to monitor sermons

August 1, 2014 — bunkerville

On Friday, the IRS settled a lawsuit filed in 2012 by the Freedom from Religion Foundation (FFRF). The Wisconsin group brought the lawsuit because it said the IRS was ignoring complaints about churches violating their tax-exempt statuses. Specifically, FFRF said many churches promote political issues, legislation, and/or candidates from the pulpit in violation of the 1954 Johnson Amendment, which requires that non-profits not endorse candidates. (One of those wink-wink set up settlements probably)

According to FFRF, the IRS has not followed a 2009 ruling requiring it to hire someone to keep an eye on church politicking. The IRS says it hasn’t ignored the ruling, but merely failed to follow it.

Today, more emails were released from Congressional investigations into the IRS scandal. You know, the one where our Dear Leader used federal agencies to target the political opposition with repression and abuse. The Wall Street Journal reports today, in an article called “The IRS’s Foreign Policy“, that now evidence has emerged that it wasn’t just American conservative groups our president was criminally targeting for special attention. It was targeting groups supporting the Jewish State of Israel.

An IRS email unearthed in Congressional discovery asks these questions to a Jewish group applying for tax-exempt status: (1) “Does your organization support the existence of the land of Israel?” and (2) “Describe your organization’s religious belief system toward the land of Israel.” So tell me how that issue is worthy of IRS attention? The obvious answer is that it is not. It’s only relevant to a presidential administration taking its cues from an anti-semitic leader.

Then there could be this responsibility.

At least they knocked which is saying something.

For almost 40 years, Carole Hinders has dished out Mexican specialties at her modest cash-only restaurant. For just as long, she deposited the earnings at a small bank branch a block away — until last year, when two tax agents knocked on her door and informed her that they had seized her checking account, almost $33,000.

Then there is this keeping in mind that Biden is not at the wheel:

“We cannot continue to rely only on our military in order to achieve the national security objectives that we’ve set,” Obama said. “We’ve got to have a civilian national security force that’s just as powerful, just as strong, just as well-funded.”

All Democrats voted for this bill, more than doubles the size of the IRS.

IRS is to get 5000 more guns; 5 million rounds of ammo; if they hire 87k they will have 167k employees; impressive brown shirt army. The IRS has 4,487 guns and 5,062,006 rounds of ammunition in its weapons inventory

Here is the something that is a possibility for those tens of thousands. Mark Levin 2014.

Sources are from earlier Bunk’s posts including:

It’s Not Just the 87,000 New IRS Agents, It’s who They Will Be – What They Will Do!

The best of the swamp.